The Social Security Administration (SSA) stated in a recent blog post that they will no longer be able to mail out paper Social Security estimated benefit statements.

Recent budget cuts have forced the SSA to make some changes, including a hiring freeze that began in 2016, and more recently, the decision to send out fewer paper statements.

According to the SSA blog, paper statements – showing your estimated benefits and earnings history – will only be sent to people age 60 and over, who are not currently receiving benefits, and who do not yet have a my Social Security account.

Sending fewer paper statements should cut administrative costs by a little over $11 million in 2017.

This story may sound familiar to you. That’s because the SSA made the same decision back in 2011. The SSA made online statements available in May 2012 and had planned on stopping mailing paper statements to all workers at that time.

However, after receiving much criticism, the SSA resumed mailing paper Social Security estimated benefit statements for workers as they reached key ages, starting with age 25 and then every five years up until you start collecting benefits.

The more recent decision to stop mailing paper statements will go into effect starting in January 2017. At that time, if you are under age 60 you will no longer receive statements in the mail. If you are age 60 or over and you are not yet receiving benefits, you will continue to receive paper statements unless you have signed up for an online account.

If you have signed up for an online account, simply login and click on Estimated Benefits. You can view your estimated benefits online or you can print your full statement.

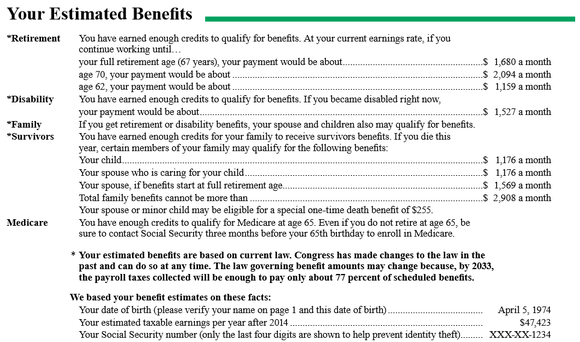

Your estimated benefit statement will show the following information:

- Your retirement benefit estimate at your full retirement age, at age 70, and at early retirement (age 62).

- Whether you qualify for disability benefits (I.e., have you worked enough credits to receive benefits if you become disabled) and the estimated amount,

- The amount your survivors (spouse or dependent children) will receive if you die

- Whether you have worked enough credits to qualify for Medicare or not

It is important to review your benefit statement periodically to help plan for your retirement. You should also check for errors, such as your earnings being reported incorrectly or not being reported at all.

If you are already receiving Social Security, you can review your benefit payment information online. Your benefit payment statement will show your monthly amount before deductions, any amounts deducted for Medicare (Part B or Part D), and any amounts withheld for Federal income taxes (if you elected to have taxes withheld).

Current beneficiaries will also receive Form SSA-1099 each year, which is the statement you need to prepare your taxes. This statement is still mailed out in January of each year, however, you can also view this information online.

Signing up for a my Social Security account is very easy if you haven’t done it yet. Just go to www.ssa.gov and click on the my Social Security link on the home page and follow the instructions. The whole process should take less than 10 minutes.

Once you have an account setup, you can request a replacement Social Security card, check the status of your application (if relevant), and request a benefit verification letter, in addition to reviewing your benefit estimates.

For people already receiving benefits, you can also check your payment information, change your address and phone number, and request replacement tax forms.

https://www.ssa.gov/myaccount/

Leave a Reply